What Is Going on with Mortgage Rates?

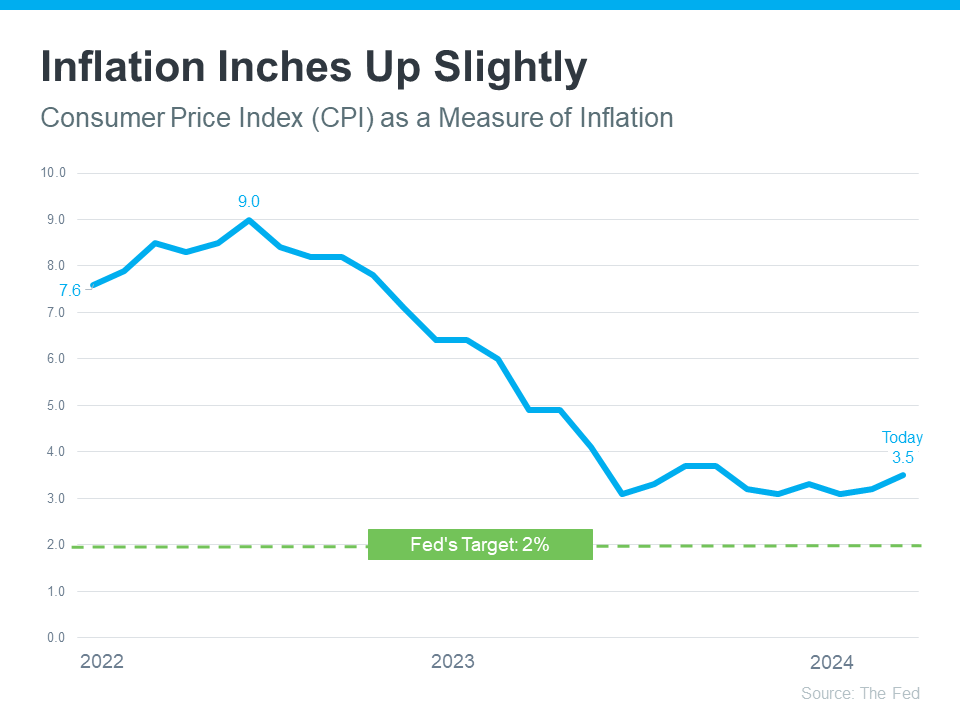

You may have heard mortgage rates are going to stay a bit higher for longer than originally expected. And if you’re wondering why, the answer lies in the latest economic data. Here’s a quick overview of what’s happening with mortgage rates and what experts say is ahead.

Economic Factors That Impac

Tips for Younger Homebuyers: How To Make Your Dream a Reality

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home? And chances are, you’re worried that’s not going to be in the cards with inflation, rising home prices, mortgage rates, and more seemingly stacked against you.

While there’s n

Newly Built Homes Could Be a Game Changer This Spring

Buying a home this spring? You’re probably navigating today’s affordability challenges and dealing with the limited number of homes for sale. But, what if there was a solution that could help with both?

If you’re having a hard time finding a home you love, and mortgage rates are putting pressure o

Orgest Lushnja

Phone:+1(904) 337-1392